The Changing Office of the CFO

Inside the Opportunity in CFO Suite Software and Services

The CFO role has evolved over time, extending beyond traditional financial reporting, becoming more strategic and requiring greater visibility across multiple business units. To enable a more strategic role, CFOs need access to real-time data across their organization and must find ways to automate lower-value activities to free-up time.

Now, many software solutions exist to enable a more strategic CFO function, across a wide range of capabilities, such as budgeting & forecasting, accounts receivable/payable automation, revenue management, cash flow management, payments and FinOps. While some companies are already embracing a combination of such solutions, most organizations are still using spreadsheets to manage CFO activities or otherwise early in their adoption of more advanced software.

The majority of CFOs recognize the availability of market solutions and the need for adoption in the finance function, with “53% of CFOs say[ing] they plan to accelerate digital transformation using data analytics, AI, automation and cloud solutions” according to PwC Pulse Survey, August 2022. As such, market tailwinds exist for CFO suite software and make investment compelling in the medium to long-term.

In order to integrate these solutions with the rest of their tech-stack and workflows, CFOs & their technology teams rely on consultancy and implementation providers for their expertise - we therefore believe the same drivers for growth of CFO suite software will provide tailwinds for such services providers. Many pockets of this services ecosystem are highly contested, and thus providers must differentiate in order to achieve sustainable growth, which often is achieved through development of proprietary technology (such as accelerators), sector specialization, deep knowledge of particular software ecosystems, and/or domain expertise (e.g. AI, Cyber, etc).

At Baird Capital, we are actively seeking investments in software and services companies that support the office of the CFO. We believe the CFO suite software landscape will demonstrate strong growth, particularly within the mid-market where adoption remains relatively low but is increasing, which should also underpin growth for associated services providers.

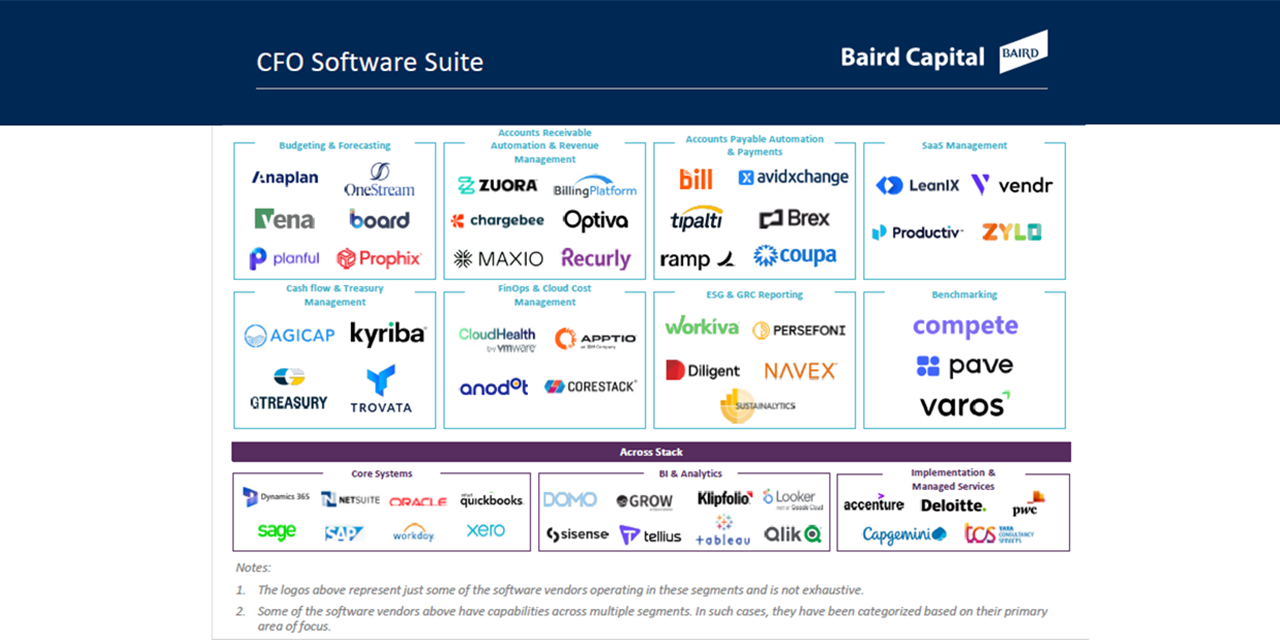

Baird Capital has identified a number of segments that fit within the CFO software suite.

Adoption of CFO suite software and services is being driven by a desire to:

Automate manual processes

Financial processes within many organizations are still highly manual and CFOs are recognizing the benefits automation can bring. Automation of financial processes, such as accounts payable/receivable and close management, can help to unlock resources to focus on higher-value activities, alongside bringing significant efficiency improvements. Accenture estimates that automation in financial close can result in a 35-40% decrease in period close times, while touchless processing of invoices, payments and reports can drive a 50-60% increase in operating efficiency.

Streamline business workflows

Those that have been slower to adopt cloud-based solutions continue to have disparate teams updating Excel documents, tracking multiple versions and planning separately. Increased focus is being placed on integrating workflows across teams, unifying data silos and using purpose-built solutions.

Reduce costs

Aside from the cost savings of automation, solutions are increasing visibility over team spending behaviors to help manage business expenses more easily. For example, FinOps and SaaS management solutions give greater oversight of organizational cloud usage and SaaS subscription costs to manage spend based on utilization, while other solutions provide greater oversight of functional business unit costs to support resource allocation.

Have access to real-time data

Real-time data is becoming important for decision-making across the business, and dedicated software solutions are a necessity to achieving this. The vast majority of companies still have a long way to go before they can achieve anything close to real-time financial visibility into their operations and are taking steps to change this.

Our Relevant Investments

Investment Date: May 2023

HQ: London, UK

JMAN is a data consultancy and managed services provider that combines commercial insights with technical capabilities to support their clients in becoming more data-driven. Its solutions are integral in supporting CFOs and the wider C-Suite in gaining access to real-time data across their organization to inform strategic decisions.

A number of characteristics attracted us to invest in the business, including its:

- Large and fast growing addressable market – The data services market is large, and growth is underpinned by a long-term need for businesses to become more digitally enabled and leverage data to enhance value.

- Sustainable differentiation – JMAN combines the commercial mindset of a management consultancy with the agility and skillset of a technology company to deliver integrated data solutions to its clients. This rare combination, combined with its offshore capabilities in India and its reputation in supporting private-equity portfolio companies provides strong differentiation in a competitive landscape.

- International growth – JMAN had already begun supporting US-based clients, and the founders were looking for a partner to help them launch their US operations and accelerate growth in the US, which is where our global platform, international experience and network can help to drive value.

- Customer success – JMAN delivers demonstrable ROI for its customers, which is evidenced through its customer feedback and drives high levels of repeat and recurring revenues.

- Founder run team – JMAN’s highly committed founder team fits with our focus on supporting founder-managers as they scale their business to the next level.

“Access to real-time data across the organization is a key priority for all of our clients to help underpin and execute their value creation plans, including generative AI strategies. Many businesses are still early in their data journey, and their needs are constantly evolving, which I believe will drive long-term growth in this space.”

Anush Newman, CEO

Investment Date: May 2023

HQ: London, UK

Freemarket is a leading fintech platform for regulated B2B cross-border payments and currency exchange. Its solutions provide clients’ finance and treasury teas with greater oversight of their cross-border payments and streamlines the process to make cross-border payments more efficient.

A number of characteristics attracted us to invest in the business, including its:

- Attractive market backdrop – The cross-border B2B payments market is large, fast-growing and resilient across economic cycles. Technology-led providers are taking share from the traditional banks, which is providing substantial opportunity for independents to achieve strong revenue growth.

- Strong value proposition – Freemarket’s technology and banking relationships provide customers with increased flexibility, oversight and access to better pricing versus other solutions on the market.

- International growth – At the time of our investment, Freemarket was in the process of seeking approval for its Irish banking license, which would provide market access to the entire European Economic Area. This license has now been granted, and we believe further opportunities exist for international expansion, where Baird Capital can leverage its experience and resources to support.

- Founder-run team – Freemarket’s highly committed founder team fits with our focus on supporting founder-managers as they scale their business to the next level.

“International payments is an important yet highly complex activity for the global businesses we work with, who are typically making many payments in multiple currencies around the world. Our solutions help to streamline the process and provide greater oversight and reporting capabilities to support the finance and treasury functions of our clients.”

Alex Hunn, CEO

Investment Date: July 2023

HQ: Austin, TX

Osano is a data privacy management platform that solves for consent management, data subject rights, assessments, and vendor risk — all in one place. Its solutions assist CFOs in mitigating financial risk associated with complex data privacy regulations and actively reducing costs, as most companies have dedicated staff manually handling data privacy rather than using an automation solution.

A number of characteristics attracted us to invest in the business, including its:

- Favorable market tailwinds – Privacy remains a top priority in managing cyber and IT risk as modern regulations continue to impact the processing of personal data. By 2024, government regulations requiring organizations to provide free and accessible consumer privacy rights will grow to cover five billion citizens and more than 70% of global GDP.

- Notable customer base – Osano has strong traction among mid-market and increasingly enterprise customers.

- Best-in-class technology – Osano’s cookie/consent management is top-tier and the most critical product within the data privacy compliance suite, carrying the highest risk for customers when not implemented.

- Experienced management team – Osano has a seasoned leadership team with significant B2B SaaS expertise and a track record of execution.

Investment Date: September 2022

HQ: Reston, VA

Tellius is an AI-driven decision intelligence platform that accelerates data insight and decision making within organizations. Its solutions enable CFOs to generate faster insights, reduce analysis time, and easily spot opportunities for cost savings.

A number of characteristics attracted us to invest in the business, including its:

- Impressive traction – Tellius is rapidly growing and has a strong, loyal customer base.

- Attractive market opportunity – The Business Intelligence & Analytics market is a unique segment with meaningful growth expected in the near / long-term. There is an increasing need for cloud infrastructure, augmented analytics and reporting tools to improve business decision-making.

- Advanced technology platform – Tellius truly has differentiated and robust technology – its purpose built dual analytics engine intelligently routes queries to the most efficient engine for sub-second ad-hoc queries and robust artificial intelligence / machine learning workloads. Tellius has flexible architecture with unique multi-variable analysis and data preparation capabilities.

Investment Date: November 2022

HQ: Indianapolis, Indiana

Zylo is an enterprise SaaS management and optimization platform designed to discover SaaS applications, recommend and automate optimization actions, help manage renewals, rationalize redundant applications, and provides access to library of API integrations for SaaS applications. Its solutions are a mainstay for CFOs in efficiently controlling costs.

A number of characteristics attracted us to invest in the business, including its:

- Strong value proposition – Zylo has a clear value proposition and ROI centered around cost savings, time efficiencies and contract optimization with multi-year value from benchmarking, renegotiations, provisioning, and API integrations.

- Favorable market tailwinds – The pandemic and related changes to technology required for remote access has dramatically impacted the processes for procurement, usage and oversight of enterprise IT and SaaS. Zylo is well-positioned to support these dynamics by providing visibility, governance, and automation to the CFO.

- Stellar leadership – Zylo has an experienced, well-regarded management team with relevant background and a strong network.

Investment Date: May 2023

HQ: Edina, Minnesota

Parallax is a provider of capacity and resource planning software that enables its customers to optimize operations and profitability via enhanced and predictive resource planning and forecasting. Its solutions aid CFOs in automating workflows, improving governance, and providing organizational insight into past performance and forward-looking forecasts used to drive strategic decisions.

A number of characteristics attracted us to invest in the business, including its:

- Attractive market opportunity – There is a multi-billion-dollar market opportunity for software and automation in the professional services industry, including the Company’s initial target market of digital services firms and other adjacent professional services segments (e.g., accounting, management consulting, architecture/engineering, legal, etc.).

- Strong commercial validation – Parallax has diversified customer traction ranging from small and mid-sized businesses to select large/enterprise level companies.

- Advanced technology platform – The Company’s software platform provides advanced predictive resource planning and forecasting capabilities and was built for flexible customer deployments, with pre-built integrations to other third-party software CRM, time tracking, project management and finance tools.

- Experienced management team – Parallax’s leadership team has deep industry knowledge and credibility from previous experience building and managing a large software design and development consultancy.

Our Strategy

Baird Capital manages two complementary but distinct investment strategies: Global Private Equity and Venture Capital. Each strategy is overseen by an experienced team that invests alongside entrepreneurs and founders who are passionate about their businesses. We look for opportunities to invest more than financial capital – we look for companies where we feel we can deliver additive resources, relationships, and expertise to accelerate their growth.

Venture Capital |

Global Private Equity |

|

|---|---|---|

| Industry Focus | B2B Technology & Services | |

| Investment Type | Mid-Stage Venture to Growth Equity | Growth Equity to Buyout |

| Target Investment Size | $10M to $20M per Company | $15M to $50M per Company |

| Target Ownership % | 10-30% | 20-80% |

| Target Company Size | $2-15M of Revenue | $10-100M of Revenue |

| Geographies | U.S., Canada | U.S., U.K., Asia |

| Value Add Resources | Operating Advisors, Global Platform, Executive Network, Capital Markets Expertise, Corporate Relationships | |